Get smart on a property, fast

Source, screen, and underwrite more multifamily commercial real estate (CRE) deals in less time with greater confidence.

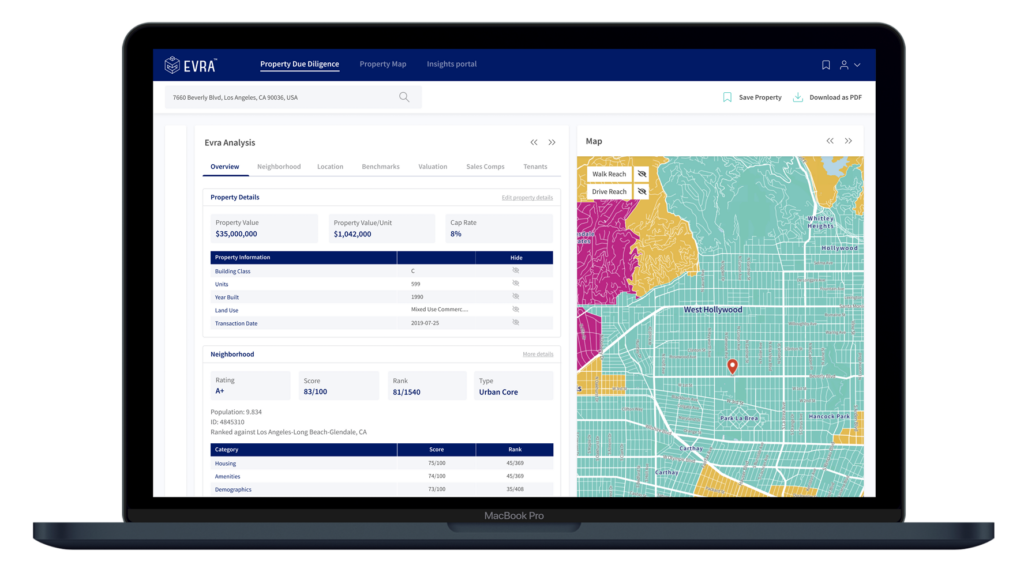

Evra by GeoPhy gives CRE professionals the data and insights to understand the attractiveness, health, and risk of a property, its tenants, and its surrounding area.

The Evra commercial real estate (CRE) platform provides flexibility along with the most granular data and analytics available. It provides property level details as well as the surrounding context at metro, submarket, and neighborhood levels.

Uncover Property Insights

Evra is making the world of CRE more transparent, efficient, and faster

Deal Origination

Continuously pre-underwrite properties to define most attractive opportunities at any given moment in any given market

Property Screening

Size opportunities by market / submarket / neighborhood based on your custom criteria

Underwriting

Workflow integration to make underwriting faster and more efficient with a micro-applications approach

Evra Features

Automated Valuation Model (AVM)

Generate a highly accurate value estimate for multifamily properties in any market across the continental US in seconds.

Valuation: $24,949,000

Tenant Credit Profile (TCP)

Quickly evaluate the risk or opportunity associated with multifamily assets based on aggregated tenant credit scores, estimated income, delinquency rates, and more.

Average Tenant Credit Score: 659

Neighborhoods & Multifamily price indexes

Identify attractive and overlooked neighborhoods in any US market rapidly.

Neighborhood Rating: B+

Benchmarks & Value Drivers

Assess property location’s attractiveness against those in its metro area.

Neighborhood Household Income: $57,462

Comps

Quickly find comparable, nearby, and recent transactions when evaluating multifamily properties.

Comp 1: $24,400,000

Comp 2: $26,000,000

Tenant Population Indexes (TPI)

Understand and monitor trends in occupancy for multifamily properties at a property, neighborhood, and metro area level.

Two-Year Tenant Population Index: 98.1%

The Evra Platform

CRE data, delivered as you want it

Web Application

Data at your Fingertips.

Evra allows you to dig into the data and insights directly, with scores of tools to tailor your analysis. It provides the flexibility to change criteria for your analyses on the fly – and download a PDF to include with your deal memo.

API

Straight to your Systems.

Tap our API to add plug Evra’s data into your existing business intelligence tools. We’ll work with your IT teams to get all data correctly flowing to the right locations. Evra updates the data automatically on a timetable that works best for your IT department.

Data Append

Direct to your Spreadsheets.

Our analysts can your spreadsheets’ property addresses with Evra information such as neighborhood crime statistics and the trend in properties’ average tenant credit scores. We deliver the resulting data in Evra’s secure Client Portal.