The GeoPhy AVM: Accurate Assessments of Value

[This article is the 2nd part of a series on the GeoPhy AVM, and follows the article ‘Location, Location, Location‘].

Though perhaps not top of mind for real estate professionals on a day-to-day basis, accurate assessments of real estate value critically underpin our financial markets across the lending and investing cycle — whether it’s initially screening a potential acquisition or deal, underwriting a loan on a commercial real estate asset, reporting to investors on the financial performance of a property investment, or assessing the value of collateral in a refinancing or work-out scenario. There is also a strong macro-economic dependence on property valuations — as an input to measuring and benchmarking the performance of commercial real estate, assessing the exposure of (systemically important) lenders to commercial real estate, and determining the strategic asset allocation of institutional investors to commercial real estate.

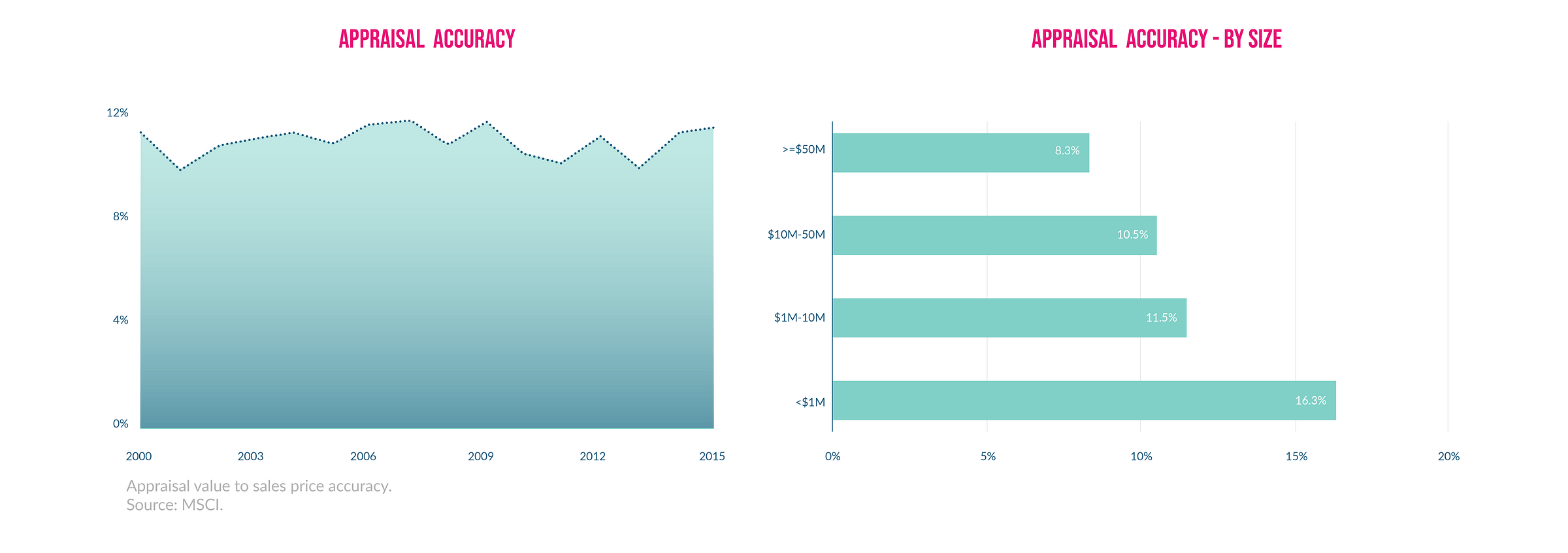

Contrasting the importance of valuations, not much is known about the actual accuracy of real estate valuations, “appraisals” in jargon, other than the occasional anecdote, and the intuition that appraisals “are typically off.” MSCI, a global index provider (including a series of private real estate indices, formerly known as IPD), releases annual snapshots of valuation-to-price-comparisons that analyze differences between appraised property values and subsequent transaction prices. Their analysis consistently reports an absolute difference of ≈12% between appraisals and subsequent transactions.

To put that in perspective, imagine lending at an 80% loan-to-value (LTV) to a $100 million property, which really should be worth $88 million — that all of a sudden is an LTV of 91%! Consider that same scenario from the perspective of an investor. The return on the investment would be -12% from the start (on an unlevered basis, or -60% on a levered basis). Further analysis also exposes substantial variation in the difference between appraisals and transactions over time, and across countries and property types, with larger buildings apparently ‘easier’ to appraise than small buildings.

Now, it’s easy to dismiss appraisals for their relative inaccuracy, and with that to dismiss a somewhat outmoded appraisal industry. However, as the individual building we walk by, work at, or invest in, increasingly become critical components of the portfolios of pension funds and insurance companies, of bank balance sheets, and of the government-at-large (think about the explicit backstop that the government provides to Fannie Mae, Freddie Mac, and other housing institutions), it grows increasingly perilous to continue avoiding the need for more accurate valuations in the commercial real estate sector.

Real estate is no longer about just buying and selling buildings. There now exists an entire financial industry built on the sector. Of course, regulators are aware of the importance of commercial real estate, and the relative inaccuracy of appraisals. That has led to some regulation, especially following the “most recent’ financial crisis. Regulation that, for example, stipulates the use of well-trained, certified valuation professionals, that are truly independent, unbiased agents. However, that regulation does not change the current method of appraisals. It merely reinforces the use of existing processes, which perpetuates inherent inaccuracy. If anything, this regulation has made it harder for investors and lenders to disregard appraisals, or to force change upon the industry.

With the advent of data promoting the potential for more transparency in the commercial real estate industry, alternative methods that generate more accurate valuations are emerging. These ‘alternative methods’ include new technology-based programs or software that accelerate process efficiency and workflow, in addition to comp, cost, or discounted cash flow approaches.

Now, enter modern automated valuation models (AVM), robust algorithms leveraging big data and machine-learning to provide model-assessed values of properties at any specific point in time. These AVMs can take different approaches to compute a property’s value. However, they do not have to depend on the use of a capitalization rate (or “cap rate,” in jargon). Critical in traditional property valuation techniques, cap rates require a simple calculation of an asset’s net operating income (NOI) divided by its transaction price. For valuation purposes, the cap rate will typically be derived by considering 3–5 recently transacted, nearby buildings, adjusting for differences between the appraised property and the transacted properties.

By contrast, an AVM incorporates all transactions in a given market, assuming a relationship between value and independent variables that is consistent across locations.

We previously described how the critical input of ‘location location location’ can be quantified using modern as well as traditional sources of contextual data. Using (simple) machine learning techniques, the GeoPhy AVM sifts through this data to assess the value of a commercial real estate asset, where the user provides input on a small, but critical set of property characteristics such as NOI. The result of this model is a valuation that is both instant and accurate.

Now, ‘instant’ can be objectively measured. It takes the GeoPhy AVM approximately 4 seconds to return a valuation using an online tool or API query. That compares favorably against the time required to obtain a broker-opinion-of-value — typically 2–3 days — let alone the time it takes to obtain an appraisal — 4 to 5 weeks on average.

Similar to the MSCI analysis referenced above, ‘accurate’ can be objectively assessed by comparing valuations to actual transaction prices. We can measure the current accuracy of the GeoPhy AVM with precision. The median difference between the GeoPhy AVM valuation and transaction price is 6.27%, approximately 50% more accurate or double the precision compared to a conventional appraisal. That exact measure of accuracy changes over time as the base of property transactions expands, and as the GeoPhy AVM learns and adjusts.

Valuations that are instant and 50% more accurate may sound exciting to some, while rather dull to others. However, the accurate assessment of value for commercial real estate has real implications for financial risk and return and should be central to the wokings of an efficient capital market. As an illustration for the use of the GeoPhy AVM, consider the commercial mortgage-backed securities issued by Freddie Mac, one of the largest lenders in the US multifamily space. These securities are part of the $3 trillion commercial mortgage-backed securities (CMBS) market through which many pension funds, insurance companies, and other institutional investors gain exposure to the US commercial real estate market. Using the GeoPhy AVM, an investor can accurately assess, at any point in time, the value of the underlying assets in a Freddie Mac K-Series deal. This valuation is relevant for CMBS investors at issuance, but especially over the lifetime of a loan, as market conditions and property performance change and the value of the collateral becomes more important.

Since 2003, almost 20,000 commercial real estate assets have been securitized through the Freddie Mac K-Series, including both acquisition and refinancing loans. Focusing on just 2018 and 2019 (year-to-date), that number is about 4,000 assets, with a collateral value of $70 billion. By all means, the Freddie Mac K-Series program is significant, although it is just a small part of the overall CMBS market. Freddie Mac puts some restrictions on the mortgages that can be securitized. It requires a minimum debt-service-coverage ratio (DSCR) — an indication of the ability of the borrower to make payment of interest and repayment of the principal — and a maximum LTV ratio — an indication of the extent to which the value of the property, or collateral, exceeds the value of the mortgage. Given that the cost of debt is typically lower than the cost of equity, most investors will pursue a mortgage that minimizes the DSCR or maximizes the LTV, where one parameter may be a constraint for the other.

The DSCR can be nominally influenced, for example, by occupancy and rent growth assumptions, and by making adjustments to capital expenditures. The one parameter that influences the LTV ratio is the appraised value of the property. Of course, appraisals are independent and objective, but in any part of the capital market, there is always a healthy tension between principals and agents, or in this case, borrowers and lenders — there are company rules, government regulations, and rating agencies to supervise these “tensions,” but it may lead to stretched valuations in some cases, or outright fraud in others.

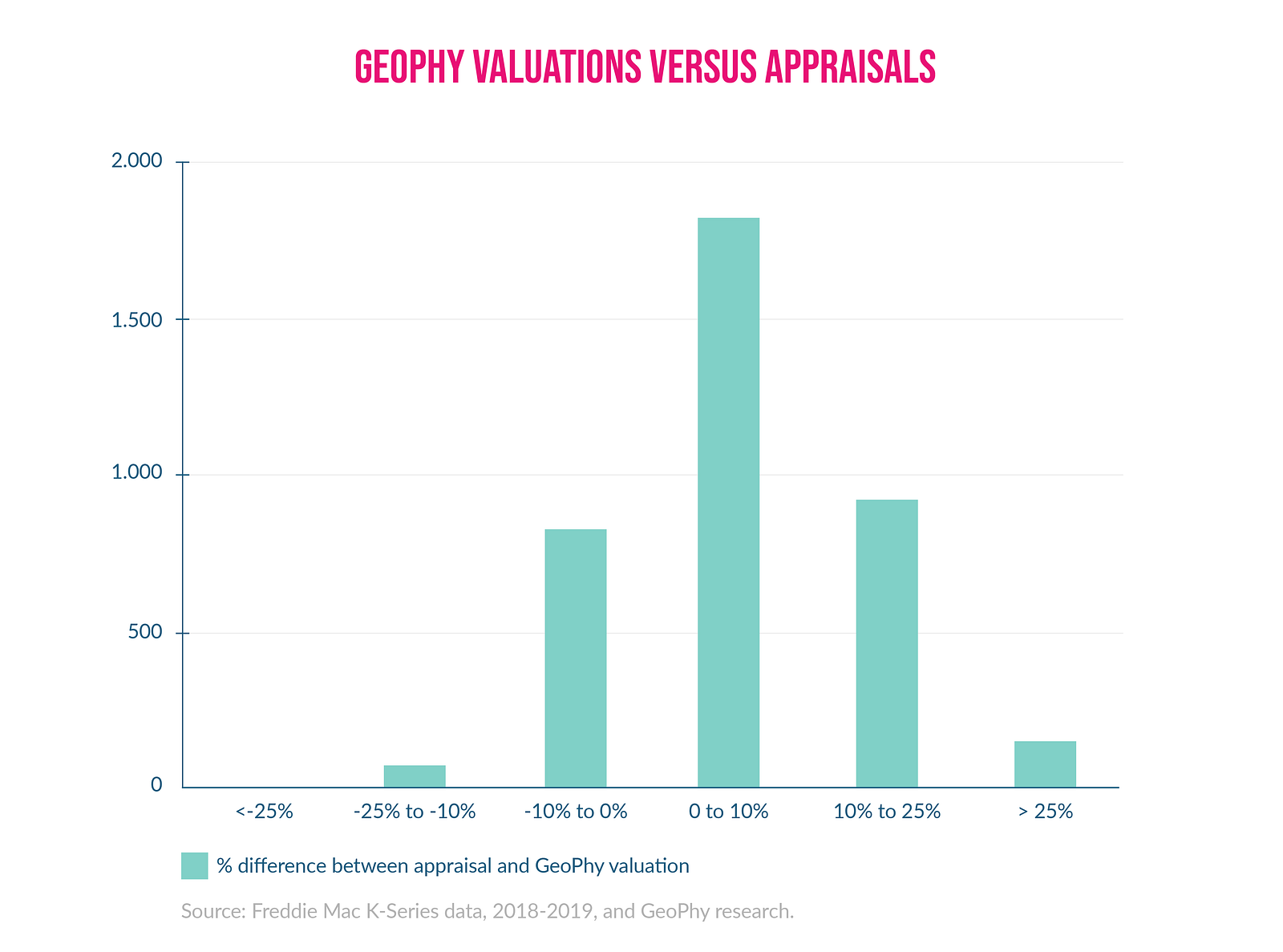

Using the GeoPhy AVM, we evaluated the model assessed value of multifamily assets securitized by Freddie Mac during the 2018–2019 period. These calculations are based on the assumption that the underwritten NOI reported by the borrower/underwriter is correct. We then compare the GeoPhy valuations to appraised values of each asset. Of the 3,826 assets evaluated, more than three quarters (75.9%) have an appraised value that is higher than the GeoPhy valuation — 48% is higher by 0–10%, 24% is higher by 10–25%, and 4% is higher by more than 25%.

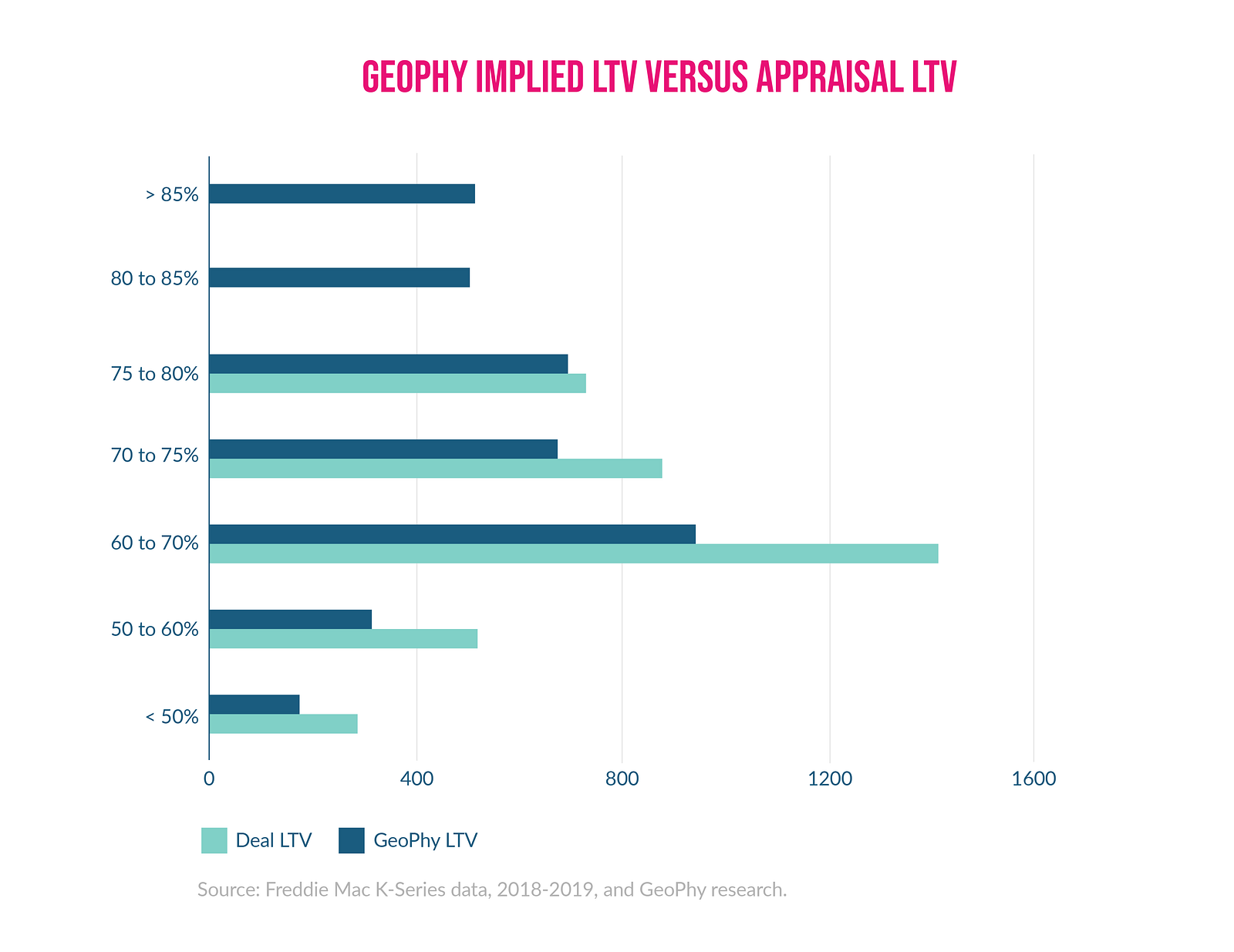

One could argue that higher or inflated appraisals are not a problem perse, as long as this is consistent across markets and over time. However, appraisals translate into LTVs, and inflated LTVs pose a risk to banks and CMBS investors, in case a loan does not perform, and the collateral value becomes important. Comparing the appraisal-based LTVs of assets securitized by Freddie Mac during the 2018–2019 period with LTVs based on the GeoPhy AVM, we document 26.7% of the loans have LTVs that are actually higher than 80% (the Freddie Mac threshold) — 13.2% of the loans are in the 80–85% LTV bucket, and 13.5% of the loans are in the >85% bucket.

Objectively analyzing the collateral value at issuance of multifamily assets securitized by Freddie Mac is just one application of the GeoPhy AVM. This simple exercise shows that there is a significant deviation between appraised values and actual collateral value — there may be multiple reasons for this deviation, but there is no doubt that one of the underlying drivers is the inflated value of appraisals at the time of financing. Commercial real estate represents a critical part of the financial system, an important part of institutional portfolios, and a cornerstone of the economy. Accurate assessment of the value of commercial real estate is critical to understand performance and risk of real estate investment and lending decisions — current appraisal methods and processes are neither accurate nor do they capture the velocity of commercial real estate valuations.

At the current point in the real estate cycle, the question is not whether, but when the next downturn hits. More modern, automated valuation models may help to avoid overly optimistic lending decision now, avoiding real economic loss down the road.