Getting Ahead of Forbearance

Combining TCP with Freddie loan data improves forbearance predictions

The COVID pandemic brought challenges to the commercial real estate (CRE) market. Even in the surprisingly stable multifamily asset class, there still have been about 800 Freddie Mac mortgages that have entered into COVID forbearance agreements since April 2020.

GeoPhy provides customers insights by combining different types of data. We wanted to see if we could predict forbearance for multifamily loans using a combination of traditional and non-traditional data.

A new take on an old problem

How do lenders currently anticipate mortgage forbearance? Traditionally, lenders use loan characteristics, relying heavily on loan-to-value (LTV) and debt-service-coverage-ratios (DSCR) to predict whether a borrower will seek mortgage forbearance.

Our approach: match Freddie Mac loan data – both for loans that went into and those that avoided forbearance – with GeoPhy’s proprietary tenant credit health and our wide range of property data. We sought to identify characteristics of properties that went into distress and resulted in requests for forbearance.

After all, rent collections support debt service. Though overall multifamily rent collections have held up reasonably well over the past year, the devil is in the details.

What drives rent collections? We believe looking at tenants’ credit health can give an early warning signal of rent collection because it indicates tenants’ ability to pay. We would expect linking GeoPhy’s unique Tenant Credit Profile (TCP) data on the credit health of multifamily tenants to Freddie Mac’s forbearance data should identify problem properties.

GeoPhy’s TCP provides building-level, aggregated credit scores and metrics for tenants currently living in most U.S. multifamily properties. It is updated monthly and includes two years of historical trends, providing CRE professionals timely and forward looking views on tenants’ financial health.

By setting a minimum limit of at least 10 credit profiles per property, TCP also ensures both tenants’ privacy and a large enough sample to remove idiosyncratic noise. Of those approximately 800 Freddie Mac loans, 552 were for properties that met our TCP privacy criteria – a sufficiently large sample to allow us to produce an analysis.

What stands out?

We employed a decision tree classification algorithm to identify which of the more than 100 property, loan, and credit characteristics we track in GeoPhy’s Value Drivers are the most distinctive for properties in forbearance. They included:

- Smaller properties

Freddie Mac Multifamily mortgage data shows smaller properties in terms of number of units were hit the hardest by the COVID pandemic1:

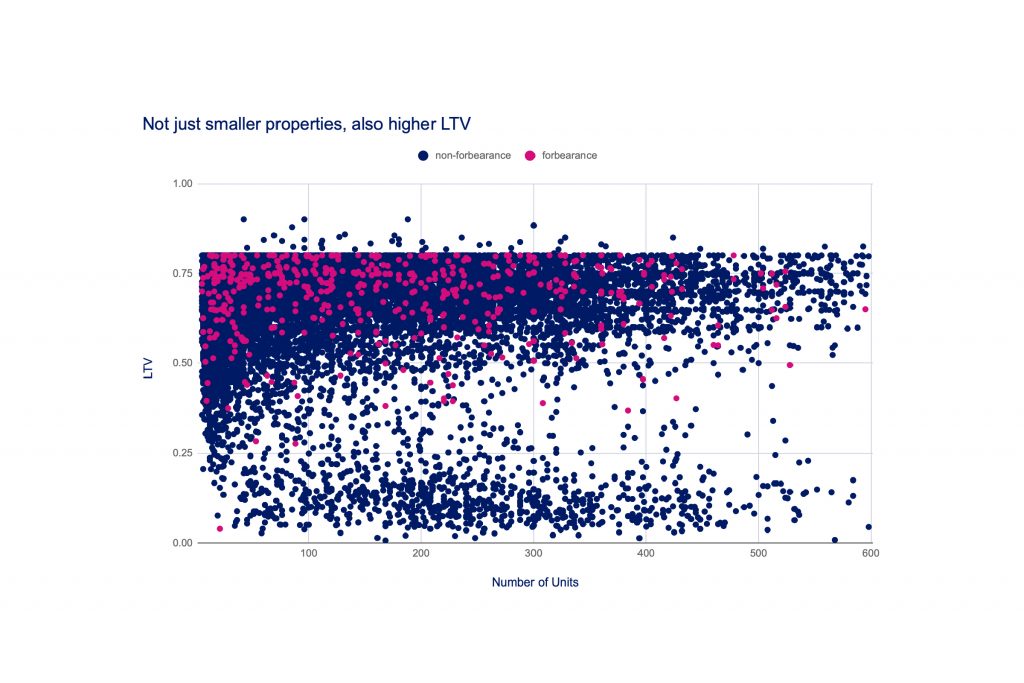

- Higher LTV

Bankers’ old friend LTV shines as a predictor that properties will land in forbearance, being more indicative of future distress than number of units:

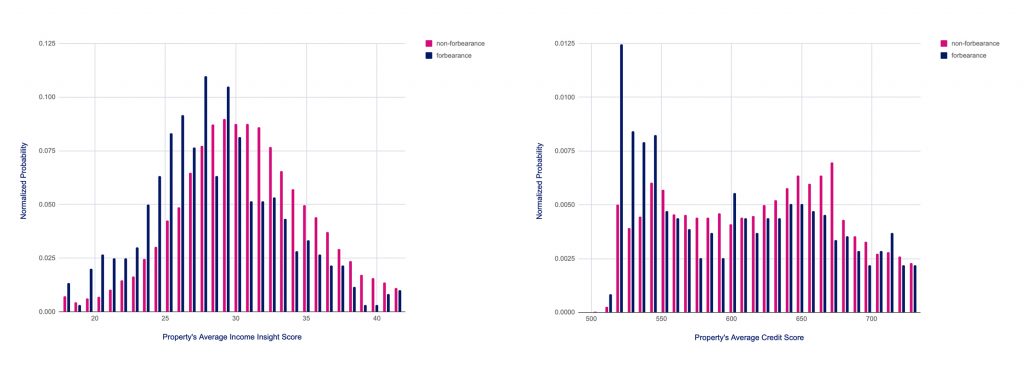

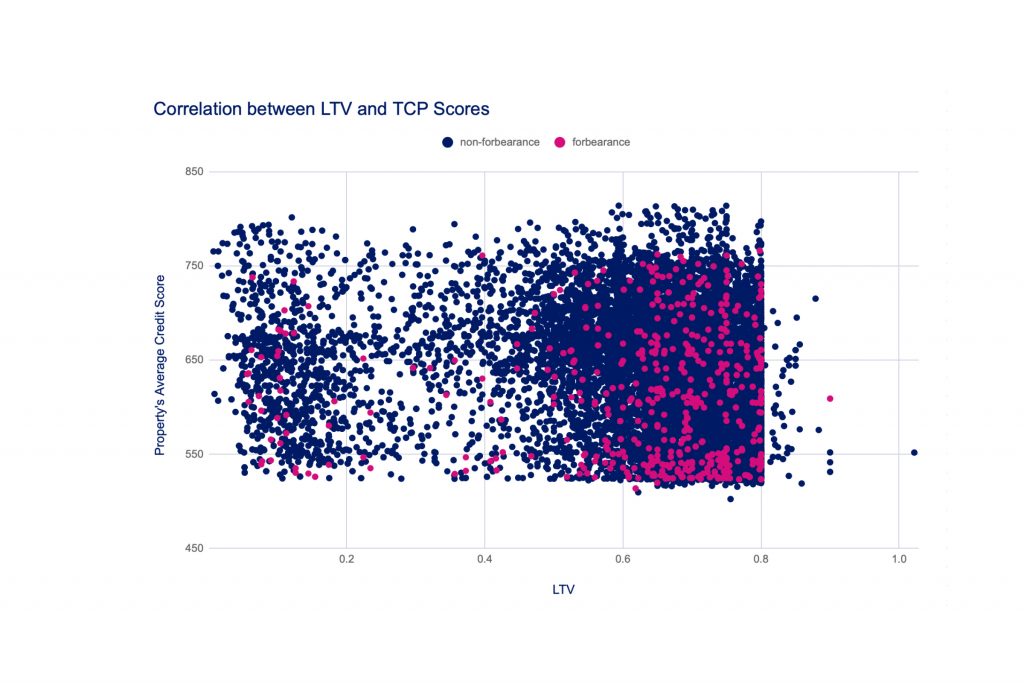

- Tenant Credit Profile

Our aggregated tenant credit data for a property provides an additional differentiator. TCP shows properties with mortgage payments that have been granted forbearance by their lenders have lower credit scores on average compared to properties that continue to pay their mortgages. Credit scores embed a time series of a consumer’s payment history over the preceding 24 months. So, a lower credit score in TCP encapsulates deteriorating credit over leading up to forbearance. TCP complements LTV nicely – flagging more properties than just using one of these characteristics alone:

Our methodology

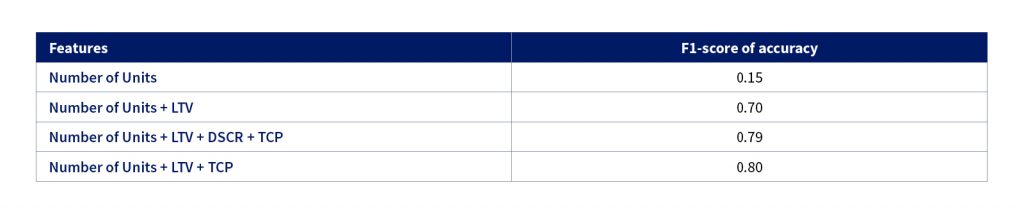

Adding multiple characteristics to this model generated small but significant improvements throughout our testing. We measured performance with an F1-score, a technique that gauges the prevalence of both False Positives and False Negatives to determine the accuracy of an analysis. (Higher is better.)

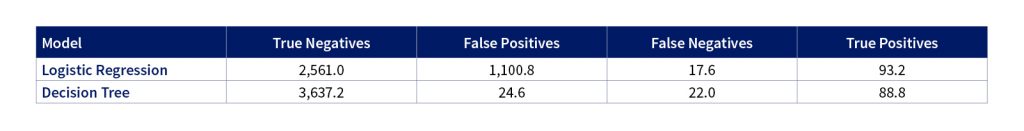

We chose a tree model over a simple logistic regression for our analysis. A simple logistic regression produced far more False Positives than a Decision Tree with this data set:

This result suggests potential non-linearities between the model features – relationships that a logistic regression cannot capture.

How Clients Use TCP

So, if you’re a lender or an investor in multifamily mortgages, what do these findings mean for you? We believe that our unique tenant credit data provides additional predictive value beyond traditional measures typically used to evaluate non-payment risk. The data could be used at multiple points in the underwriting process:

- Acquisition analysts: Adding TCP accelerates your screening process, ensuring you’ll find loans that are higher quality collateral;

- Lenders/debt investors: Bringing TCP into your process reduces up front risks and helps you monitor risk more effectively going forward;

- Modelers: Including TCP is a valuable addition that will increase the predictiveness of your models

Commercial real estate professionals can also use TCP to screen off-market properties, validate underwriting assumptions, monitor owned and serviced assets, and monitor tenant migration. Interested in these applications or a special project testing a hypothesis this blog sparked for you?

Whether to explain our product or exploring new ideas to test against our data, we would welcome your reaching out to us!

—————

1 Keep in mind that we excluded about 250 of the Freddie loans from our analysis because those properties didn’t clear our minimum number of credit profiles to be included in TCP. Property size could further increase the likelihood of forbearance.